Pacific Prime Fundamentals Explained

Pacific Prime Things To Know Before You Buy

Table of ContentsSome Known Factual Statements About Pacific Prime What Does Pacific Prime Do?Our Pacific Prime DiariesThe Best Strategy To Use For Pacific PrimeIndicators on Pacific Prime You Should Know

Your agent is an insurance coverage professional with the understanding to assist you via the insurance procedure and assist you find the most effective insurance policy protection for you and the people and points you appreciate many. This article is for informational and suggestion functions just. If the plan protection summaries in this article conflict with the language in the policy, the language in the plan uses.

Policyholder's deaths can also be contingencies, especially when they are thought about to be a wrongful death, in addition to residential or commercial property damage and/or destruction. Due to the uncertainty of said losses, they are identified as backups. The insured individual or life pays a costs in order to get the benefits guaranteed by the insurer.

Your home insurance can aid you cover the problems to your home and pay for the price of rebuilding or repair work. Often, you can additionally have protection for products or belongings in your home, which you can after that buy replacements for with the cash the insurance provider gives you. In case of a regrettable or wrongful death of a single income earner, a family members's economic loss can possibly be covered by specific insurance strategies.

How Pacific Prime can Save You Time, Stress, and Money.

There are numerous insurance plans that consist of savings and/or investment systems in addition to regular insurance coverage. These can assist with structure financial savings and riches for future generations via routine or reoccuring financial investments. Insurance can aid your household keep their criterion of living in case you are not there in the future.

The most standard form for this kind of insurance, life insurance policy, is term insurance policy. Life insurance policy generally aids your household end up being secure financially with a payout amount that is given in the event of your, or the plan owner's, death during a specific policy period. Youngster Plans This kind of insurance policy is basically a financial savings tool that helps with producing funds when youngsters get to particular ages for going after greater education.

Home Insurance coverage This sort of insurance policy covers home problems in the occurrences of crashes, natural disasters, and mishaps, together with various other similar events. international health insurance. If you are wanting to seek compensation for mishaps that have occurred and you are battling to find out the appropriate path for you, connect to us at Duffy & Duffy Law Practice

Get This Report about Pacific Prime

At our law office, we recognize that you are experiencing a whole lot, and we understand that if you are concerning us that you have been through a whole lot. https://pxhere.com/en/photographer/4223924. Since of that, we provide you a totally free examination to discuss your issues and see how we can best help you

Due to the COVID pandemic, court systems have actually been shut, which negatively influences vehicle mishap instances in a remarkable method. We have a great deal of knowledgeable Long Island auto crash lawyers that are enthusiastic about fighting for you! Please contact us if you have any type of questions or issues. international travel insurance. Again, we are right here to aid you! If you have an injury insurance claim, we intend to ensure that you obtain the payment you should have! That is what we are below for! We proudly serve the individuals of Suffolk Area and Nassau County.

An insurance coverage plan is a lawful agreement in between the insurer (the insurance firm) Continue and the individual(s), business, or entity being guaranteed (the insured). Reviewing your plan helps you verify that the policy satisfies your requirements and that you recognize your and the insurance provider's responsibilities if a loss takes place. Many insureds purchase a policy without understanding what is covered, the exclusions that take away coverage, and the problems that need to be fulfilled in order for insurance coverage to use when a loss happens.

It determines that is the insured, what dangers or home are covered, the policy limitations, and the plan duration (i.e. time the plan is in force). The Statements Page of a life insurance policy will certainly consist of the name of the individual guaranteed and the face quantity of the life insurance coverage plan (e.g.

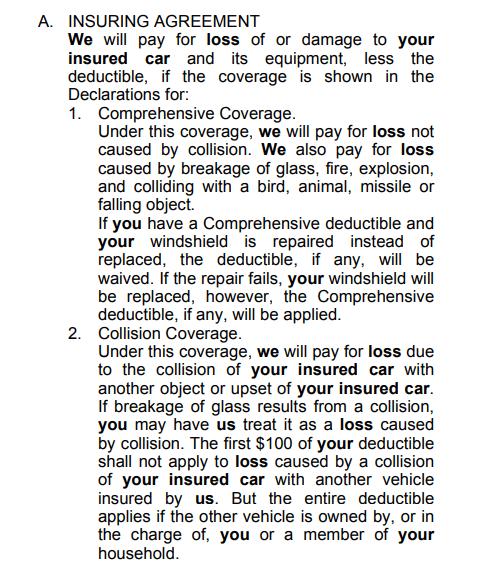

This is a recap of the significant assurances of the insurance policy business and specifies what is covered.

The 3-Minute Rule for Pacific Prime

Life insurance policies are commonly all-risk policies. https://www.indiegogo.com/individuals/37416909. The three significant types of Exclusions are: Omitted perils or reasons of lossExcluded lossesExcluded propertyTypical examples of left out hazards under a home owners plan are.